A few weeks ago, a simple altercation between two men on a subway platform escalated to a complete lockdown of London’s busiest shopping district. This incident was a perfect example of how the behaviour of a misinformed crowd can lead to astounding outcomes.

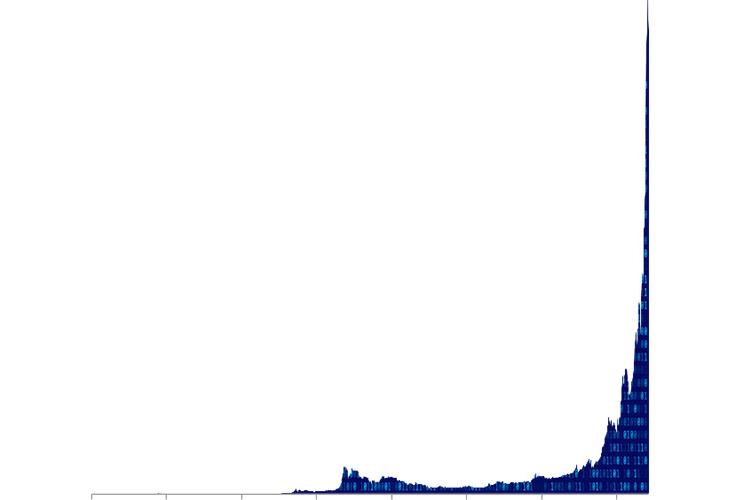

One could argue that the craze around cryptocurrencies, and particularly Bitcoin, is comparable. The dollar value of a Bitcoin has been multiplied by 10 since the beginning of the year and much of it seems to be fuelled by investors scared of missing the “crypto-rally”. As investment advisors, are we right to maintain our scepticism about cryptocurrencies or have we missed the greatest rally of the 21st century?

In 2008, in the midst of the global financial crisis, Bitcoin surfaced as the first cryptocurrency. Its creator defined it as a “peer-to-peer payment electronic cash system”. Using Blockchain technology, it relies on a network of users, powerful computers and a shared ledger to validate and authenticate financial transactions. The idea was to avoid passing through financial institutions, which made sense at a time when trust in the banking sector was shaky. Bitcoin also came at a time when Central Banks started quantitative easing. Many viewed this as highly inflationary and found refuge in Bitcoin as a stable inflation-proof store of value.

Ten years on, trust in our banking system has been re-established and unorthodox monetary policies are being wound down by Central Banks. So why is Bitcoin over 30,000 times more valuable today than when it was first launched?

Bitcoin is designed in a way that enables a maximum of 21 million coins to ever be created. This supposed strength of the currency is in fact its Achilles heel. With about 17 million coins already mined, new bitcoins are released at an ever-declining rate. This implies that if demand for bitcoin grows (for example for transactional purposes), the price of bitcoin can only rise. However, any rational person holding an asset that is bound to rise in price would be less likely to spend it. In this case, the use of Bitcoin as a medium of exchange is bound to fail. The dramatic restriction on the supply of bitcoin designed to make it a store of value is not a strength. It is its biggest weakness. If Bitcoin’s structure does not make it a useful medium of exchange, what use is it at all?

It’s becoming increasingly clear that cryptocurrencies no longer serve their intended purpose. We can find as many as 1,300 of them, that’s 10 times more than traditional currencies. But scanning the “crypto-universe” is less obvious than for other asset classes. For traditional currencies, equities and bonds, investors look at fundamentals and valuations to assess an asset’s attractiveness. However cryptocurrencies are impossible to price. What is a Bitcoin’s fair value, $5,000, $15,000? $100,000? Is it more or less expensive than Ethereum? When an asset has no true valuation criteria, it’s virtually impossible to come up with a fair valuation.

This is why investing in cryptocurrencies is a risky affair. Coming back to Bitcoin and its limited supply, the price is currently supported by a significant increase in global user base that increased from 5 million in April 2017 to over 20 million today. However if trust vanishes or demand fades for whatever reason, its price could fall to zero. There is no mechanism to reduce the supply and maintain stability. Bitcoin is only worth what someone will pay for it, making it prey to big shifts in sentiment.

The recent approval by the SEC to authorise the Chicago-based Derivatives Exchange (CBOE) to launch the futures market for Bitcoin is another threat to stability. Its integration into mainstream finance means greater volatility and an increased likelihood of drawdowns.

Another risk to watch out for are holders of large amounts of Bitcoin. It is estimated that about 40% of Bitcoin is held by 1,000 users. This type of concentration in an unregulated market exposes investors to risks of collusion and to market abuse. Since its inception, Bitcoin has fallen by 80% or more on five separate occasions, and we will not be surprised when it falls by a similar magnitude again.

As investment advisors, our recommendations are based on facts, fundamentals and valuations. Against this backdrop, we find it impossible to conclude that Bitcoin has any particular value.

But it’s not all doom and gloom. Blockchain technology itself is a valuable innovation. We are starting to see its benefit in supply chain management and international trade, providing more transparency to the end consumers. This stands in stark contrast to the opacity and confusion in the world of cryptocurrencies.

- Log in to post comments