As the Q1 earnings season draws to a close, investors were left with a mixed picture. While the S&P 500 earnings per share (EPS) growth was on average 25% with over three quarters of the companies beating analysts’ estimate, the index edged up only 50bps since the start of the season on April 13th.

The reasons behind this inconsistency are multi-fold:

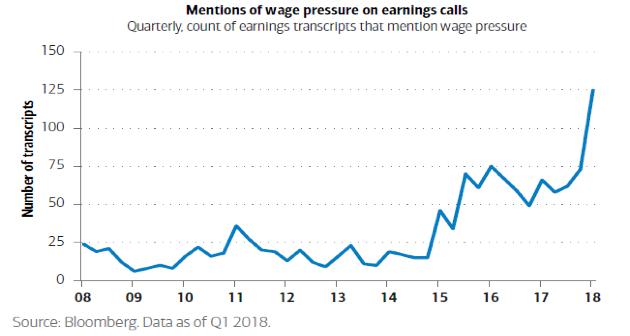

1. The US labour market is at its tightest in 17 years with an unemployment rate of 3.9%. American companies are struggling to fill jobs, it is estimated that there are close to 6 million job openings today, ranging from apple pickers to Apple Geniuses. While wage growth remains sluggish, it appears to be a growing concern that could weigh on company margins in the next quarters

2. A low unemployment rate coupled with positive economic data and an inflation rate within target, all point to a continuity of the Fed’s hawkish stance. Higher rates increases downward pressure on equities as:

- Earnings yields became less attractive as investors substitute some of their equity exposure for cash

- It increases the borrowing costs and since many companies have accumulated cheap debt over the past few years, refinancing will become more expensive and would eat into company margins

- Part of the equity upside we’ve witnessed over the past couple of years has been fuelled by share buy-backs. Higher rates will limit the ability for companies to borrow cheaply to buy their own shares

3. Tax cuts introduced in December 2017 by the Trump administration helped push earnings this past quarter. In other words, part of the stellar results can be attributed to an artificial boost and not only to strong sales and company fundamentals. Tax cuts are less likely to contribute as much in the next quarter, as this event is now priced-in

4. Tax cuts and other reform change, like the easing of the Dodd-Frank bill, had already been priced-in. “Buy the rumour and sell the news” seems to have limited the upside of the S&P 500 during the first quarter’s earnings season

5. Almost 30% of the S&P 500 revenue comes from abroad and a stronger USD may put downward pressure on future earnings. The USD is likely to remain strong as:

- The difference in monetary policy between the Fed and its Japanese and European peers means that the USD is a more attractive currency to hold

- On a Purchase Power Parity basis, the USD appears cheap and should continue to strengthen

- The US has always had a trade deficit which pushes the currency down and last month’s figure was the widest in 10 years. However, March reading shows that it has significantly narrowed and this may have added some strength to the USD

What this earnings season tells us is that fundamentals remain strong but it isn’t enough to satisfy investors. Geopolitical tensions, the prospect of a trade war and the flattening of the yield curve all point to an increase in uncertainty and weaker growth prospects. For the equity markets, this blurs the prospects of next quarter’s earnings.

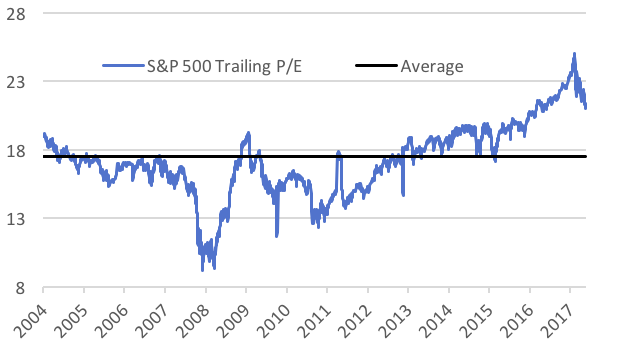

On the bright side, US valuations became more attractive. Higher earnings coupled with stable prices means that the P/E ratio is back to more sustainable levels, although still above long term average. Our underweight on US equities allowed us to reduce our exposure at a time when stocks were expensive and gives us time to plan a re-entry. However at this stage, external headwinds outweigh the positive impact of solid economic data and we see limited upside on the short term as valuations remain somewhat rich. We therefore keep our strategy unchanged.