We have taken a positive view on Emerging Market debt for some time. Over the past few months, however, we tempered our enthusiasm as we balanced relatively attractive spreads against the implications of rising protectionism for trade-dependent economies. Market developments, however, are now leading us to change our view. Valuations have become less attractive, even if our concerns regarding the macroeconomic backdrop for many markets have subsided.

A benign macroeconomic environment

The global economy has delivered a series of positive surprises since the beginning of the year. Industrial activity and global trade registered faster than expected growth in all regions. Consumer and business surveys in most major economies have registered high levels of confidence. Commodity prices recovered from extreme lows.

Many emerging markets also did their fair share in improving the outlook. In China, reforms were invigorated by supply side measures. In Brazil, despite a serious political crisis, significant reforms to public finances are being implemented. India’s fiscal and structural reform program is back on track, despite the economic uncertainties following demonetisation. In other words, the reform momentum improved.

Equally significant is the palpable change in tone from the US regarding trade and protectionism. Trump’s election promised a substantial renegotiation of trade agreements. In March, the G-20 finance ministers’ communiqué dropped the usual reference to resisting protectionism in all its forms. Two months later, the G7 communiqué re-introduced a somewhat weaker pledge to “strengthen the contribution of trade” to their respective economies.

While the US accused Canada of unfair trade practices in timber and dairy products, it is unlikely that such disputes will lead to a substantial renegotiation of NAFTA. Importantly, trade discussions between China and the US seem to have started on a very good note, with increased access for some US companies to the Chinese market. It suddenly appears as though US trade policy will not make as dramatic a turn as initially feared.

Relative valuations are stretched

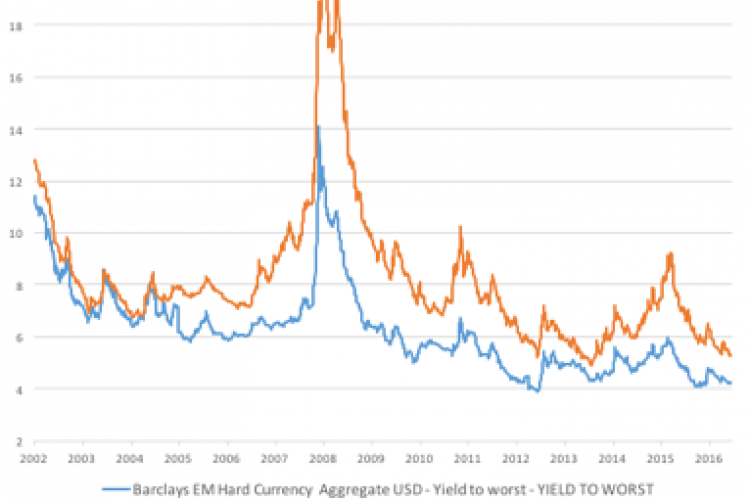

While fundamentals appear benign at this point, valuations have become less compelling. As the charts below show, emerging market bond yields are back to all-time lows. Looking within the different segments, this is particularly true of emerging market corporate issuers, rather than sovereign or quasi sovereign credits.

The difference between the segments is in part explained by the different nature of bond issuers. The emerging market corporate debt market is dominated by higher quality corporate issuers, while the sovereign market includes some low quality issuers.

Given where spreads are at this point, further spread compression is unlikely, unless there is a clear prospect for an improvement in credit quality. However, we are unconvinced that significant rating upgrades are likely. Looking at the universe of sovereign ratings from Moody’s, for example, there is a far greater number of countries on a negative than a positive outlook. Similarly, the (reasonably large) sample of corporate bonds that we follow, shows a comparable pattern.

Absolute returns will be driven by rising rates

We believe, that long term interest rates are poised for a significant increase later this year. This view is driven by two factors:

First, inflationary pressures are rising. Whether we look at wage pressures, import prices, producer prices or a host of other indicators, underlying data suggest that headline inflation is rising above the Fed’s target rate. The inflationary risks are also imbalanced: there are fewer reasons for inflation to subside than to rise.

Second, the Fed is unlikely to maintain the size of its balance sheet at current levels. Later this year, or possibly early next year, the Fed will cease to reinvest income from its bond holdings and the proceeds of maturing bonds. This should initiate a process of normalisation of long-term interest rates.

With rising long term interest rates, bond investors should expect a drop in bond prices, if spreads do not tighten sufficiently to compensate.

Reducing Emerging Market Bond exposure

Against this background, we feel that for investors focussed on absolute performance, emerging markets are unlikely to offer attractive returns. For investors focussed on relative performance, we think that an underweight allocation to emerging markets is called for. In our portfolios, we will be increasing exposure to High Yield instead.

- Log in to post comments