In short:

· A clearer outlook for the bond market is helping risk assets

· Will the China reopening fuel a global economic rebound?

· Our emerging market equity underweight has been closed

The month of January has extended a strong run for risk assets, which began in October last year. After a painful year for investors in diversified portfolios, global equities and bonds have staged a remarkable recovery this year. Investor enthusiasm has been wide spread, with equity rallies seen in the US, Europe and China. Global bond markets have also bounced, after one of the sharpest selloffs on record in 2022.

So what has lead to this renewed optimism? The second half of 2022 was characterised by a distinct fear of what could be over the horizon. A global recession driven by the coordinated withdrawal of stimulus by central banks was the consensus. Central banks, having fallen behind the curve, were forced to rapidly tighten financial conditions to combat inflation. Additionally, multi-year long asset purchasing programs came to an end. Fiscal support by governments was also quickly becoming a distant memory. Many of the structural tailwinds that had contributed to a favourable environment for risk taking were now reversing. Short periods of optimism during the year were quickly quashed by central banks, eager to win back credibility.

Throughout the year, bond investors struggled to price in a level at which they felt the Fed would stop hiking policy rates. Often they fell short, leading to volatility in bond markets not seen since the great financial crisis. During the third quarter, it started to become apparent that inflation had peaked in the US. Helped by rapidly falling energy prices, goods inflation was cooling at an unexpected rate. This improving outlook was quickly acknowledged by the Fed and ECB, who began guiding towards a slowdown in their rate hike program. This newfound clarity in the outlook for policy rates led to a much needed decrease in bond volatility.

With lower bond volatility, risk assets found a floor. Equity multiples began to expand and credit spreads tightened. Focus shifted away from inflation, towards the ever tight labour market and the prospect of a recession which had become so well telegraphed. But a sharp contraction in economic activity was avoided, with growth remaining robust in the fourth quarter. A strong US consumer - driven by a tight labour market and high levels of pent up savings, kept real GDP above expectations.

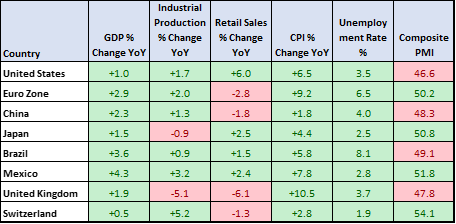

Global Economic Data Highlights

Source: Bloomberg

China is betting that a recovery in its consumer sector will lead to a domestic demand driven recovery. After years of lockdown uncertainty, the world’s second largest economy finds itself at the center of hopes for a global rebound. China’s zero-Covid strategy and the recent collapse in its property market have resulted in stagnant growth in recent years. It is clear that unleashing pent up consumer demand will result in a once off boost to growth. But for this to be sustainable, structural reforms will be required. Getting the Chinese consumer to spend more may be challenging, especially with confidence in its property market at all time lows. A shift away from infrastructure and real-estate as core drivers of growth is key. As is the focus on state enterprise and local governments. CCP officials are also working hard to restore international confidence in its private corporate sector. The crackdown on sectors not deemed to be aligned with common prosperity has hurt investor confidence. Many foreign investors have chosen to completely disinvest and seek out emerging market exposure elsewhere. If history is anything to go by, any warmer rhetoric around the private sector should be taken with a pinch of salt. As of now, outside of the U-turn in Covid policy, the CCP’s approach and long-term goals are unchanged.

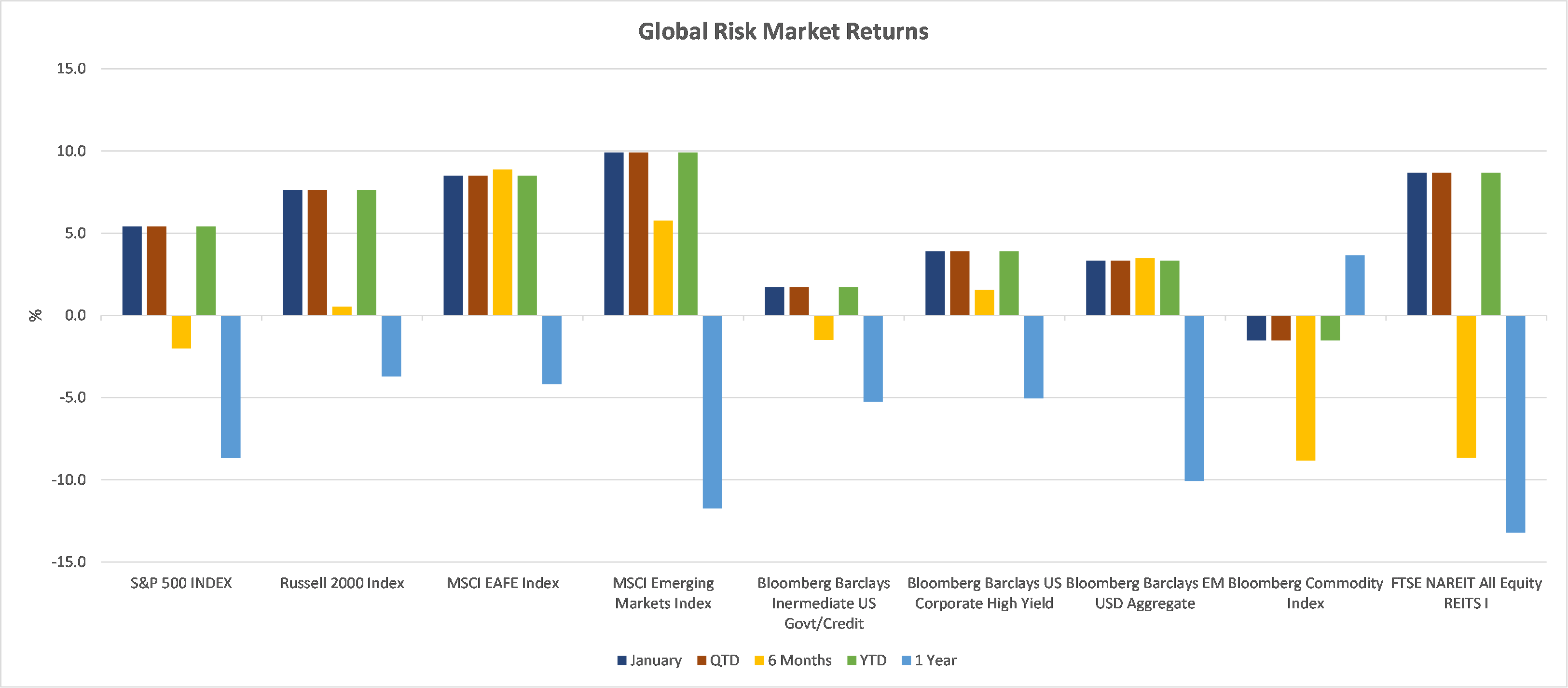

Global Risk Market Returns

Source: Bloomberg

While we still think that all signs point to an economic contraction or recession materialising later this year or early 2024, we acknowledge the danger of remaining conservatively positioned during this period. Historically, recessions are priced into risk assets only shortly before they are confirmed. This leaves investors with the danger of being too conservatively positioned in the months leading up to these contractions. Pragmatically, we are increasing exposure to equities via emerging markets this month. We are reducing tactical underweight held since mid-2022, when we reduced exposure to China due to zero-Covid policy and political interference concerns. We prefer allocating to emerging markets over European equity at this stage due to strong short-term tailwinds in China as well as less favourable valuations in Europe given the expected fall in corporate earnings.

Disclaimer:

Parkview Ltd (CRD 160171) and Parkview US LLC (160172) are registered investment advisors with the U.S. Securities and Exchange Commission (SEC). Parkview Advisors LLP is authorised and regulated by the Financial Conduct Authority (“FCA”). Registered Office is 8 Shepherd Market, Suite 5, London W1J 7JY. Parkview Ltd is a member of VQF (member number 13043). The VQF Financial Services Standards Association is organized under the terms of Art. 60 et seq. of the Swiss Civil Code (SCC) (established 1998), recorded in the Commercial Register of the Canton of Zug. VQF is the oldest and largest self-regulatory organization (SRO) pursuant to Art. 24 of the Anti-Money Laundering Act (AMLA) with the official recognition of the Federal Financial Market Supervisory Authority (FINMA). In addition, the VQF also has rules of professional conduct for asset managers which are officially recognized by FINMA and in this regard is active as an Industry Organization for independent Asset Managers (BOVV).