In short:

- Strong nominal demand and entrenched inflation point towards more of the same from central banks

- Labour market tightness may be have peaked

- Mega-cap tech companies earnings disappoint as surprises slow

October was a strong month for global equities, as investors returned to “risk-on” sentiment after a volatile third quarter. After relentless selling in much of 2022, this enthusiasm has been driven by investors once again pricing in increased likelihood of a pivot in central bank policy. But this is not the first time that this narrative has dominated discussions this year. There have been five such periods over the last 12 months, where investors have bid up equities in anticipation of such a pivot.

Thus far, investors have been too quick in jumping to this conclusion. Often off the back of a single data point, markets have been fast to react positively to bad news. In early October, the S&P 500 staged a 5.7% two-day rally following concerns around financial stability. The UK faced a potential crisis in its pension system, with overleveraged funds facing margin calls due to rapidly rising Gilt rates. Global markets were pricing in fears of contagion. Investors took this objectively bad news as a signal to buy equities - on the higher probability that central banks would need to loosen conditions in order to bring back stability to financial markets.

Since then, equities have continued to rally – despite a series of worse than expected economic data. Markets have become increasingly sensitive to housing, where activity is slowing at a rapid pace. House prices in major US cities are also showing the first signs of stress.

The US returned to positive real GDP growth in the third quarter. The headline number showed significant strength in the quarter, reflecting a tight labour market and heightened nominal activity. Services spending, a very resilient component of GDP, was the largest driver of growth. Export activity, driven by strength in industrial supplies, was also a large contributor. At the same time, we saw a significant decline in imports. Net exports therefore contributed in an outsized fashion to the headline GDP number. Much of this imbalance is driven by strong energy production and demand. It’s difficult to see these contributions continue at the same pace and scale.

Inflation in the US has remained stubbornly high, with sticky services contributors such as shelter, transportation and medical leading. The Personal Consumer Expenditure (PCE) price index, the inflation metric favoured by the Fed, showed similar increasing contributions from these areas. Resilient nominal demand and entrenched inflation will only serve to give the Fed justification for continued tightening of conditions.

Despite a rapid increase in interest rates and a correction in equities, market stability and functioning remains in place. While the central banks of Canada and Australia have begun slowing the pace of rate hikes, the Fed is unwavering in its hawkish stance for now. Credit spreads provide an indication of the relative stability of financial markets at present, with investment grade and high yield spreads still trading at comfortable levels. Given this backdrop, it is unlikely the Fed will pivot to a more accommodative stance in the near-term.

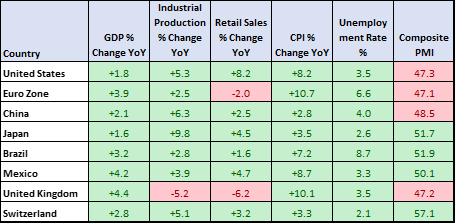

Global Economic Data Highlights

Source: Bloomberg

There are early signs, however, that we may have reached the peak in labour market tightness in the US. The growth rate of the Employment Cost Index (ECI), measuring the total cost of labour compensation, peaked earlier this year. Total Job Openings, as well as those reported as “hard to fill” have been falling sharply in recent months. Finally, the Quits Rate, indicating employee negotiating power has also rolled over. Whilst trending lower, a 5% annualised growth rate in employee costs is still far higher than the Fed will be comfortable with.

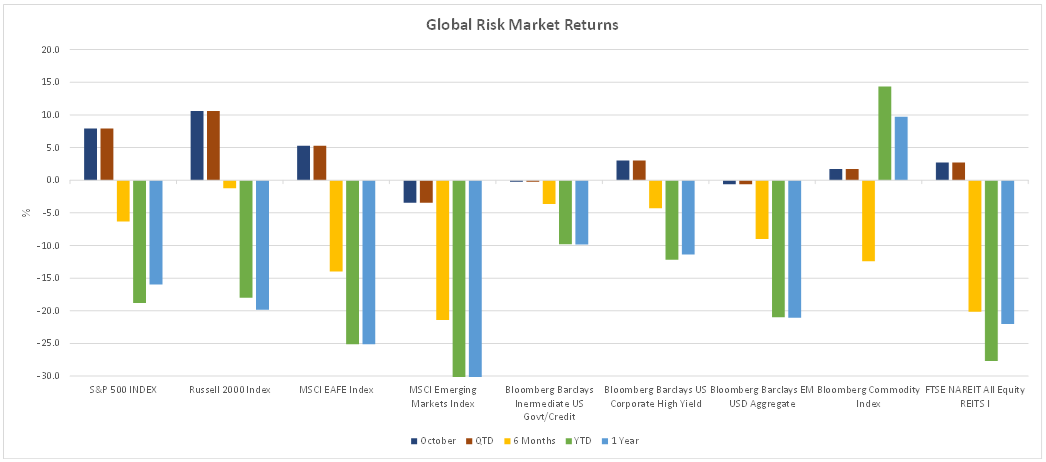

Global Risk Market Returns

Source: Bloomberg

Third quarter earnings are well under way, with around three quarters of market capitalisation in the S&P 500 having already reported. Coming into the quarter, earnings estimates were revised downward sharply. On these lowered forecasts, more than 60% of companies have so far beat their earnings estimates. But the magnitude of these surprises was below verage, at around 1%. This represents the lowest magnitude of positive earnings surprises since the first quarter of 2021 – a metric which has been steadily decreasing since then. Company revenues have held up well, supported by the strong nominal growth environment. We’ve also seen notable earnings misses and weak fourth quarter guidance from mega cap companies including Alphabet and Amazon.

Despite early clues that we may have entered the final innings of high inflation and tight labour markets, we see few reasons at this point for the Fed to capitulate on their stated goal of bringing inflation back within target levels. We remain cautiously positioned, with high allocation to cash and short duration fixed income.

Disclaimer:

Parkview Ltd (CRD 160171) and Parkview US LLC (160172) are registered investment advisors with the U.S. Securities and Exchange Commission (SEC). Parkview Advisors LLP is authorised and regulated by the Financial Conduct Authority (“FCA”). Registered Office is 8 Shepherd Market, Suite 5, London W1J 7JY. Parkview Ltd is a member of VQF (member number 13043). The VQF Financial Services Standards Association is organized under the terms of Art. 60 et seq. of the Swiss Civil Code (SCC) (established 1998), recorded in the Commercial Register of the Canton of Zug. VQF is the oldest and largest self-regulatory organization (SRO) pursuant to Art. 24 of the Anti-Money Laundering Act (AMLA) with the official recognition of the Federal Financial Market Supervisory Authority (FINMA). In addition, the VQF also has rules of professional conduct for asset managers which are officially recognized by FINMA and in this regard is active as an Industry Organization for independent Asset Managers (BOVV).